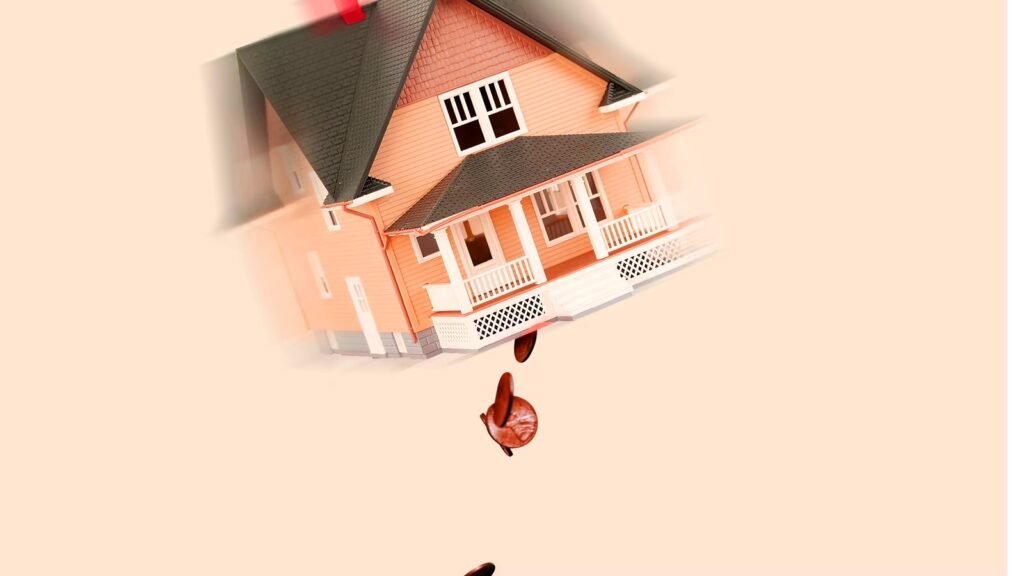

Financially devastating bankruptcy affects mortgages and homeownership. Unexpected events can plunge individuals and corporations into insolvency in the complex economic dance. This article seeks to illuminate how declaring bankruptcy can affect homeownership and mortgage stability as we navigate the financial landscape. From an automatic stay to property surrender and mortgage reaffirmation, we’ll explore the complexities of bankruptcy and offer solutions for those facing financial difficulties. Join us as we explore bankruptcy and learn how to reestablish financial stability and the goal of calling a place “home.”

Causes of Bankruptcy

Job Loss

One of the primary causes of bankruptcy is sudden job loss. The abrupt disruption of income can leave individuals struggling to meet their financial obligations, leading to a dire need for debt relief.

Medical Expenses

Unexpected medical bills can quickly accumulate, pushing individuals into financial turmoil. Bankruptcy becomes a consideration when medical debt becomes insurmountable.

Unmanageable Debt

Accumulating debt from various sources, such as credit cards and loans, can spiral out of control. Bankruptcy may provide a lifeline for those drowning in unmanageable debt.

Bankruptcy Types

Chapter 7

Chapter 7 bankruptcy involves the liquidation of assets to repay creditors. It offers a fresh start by discharging most debts, but its impact on homeownership is significant.

Chapter 13

Chapter 13 bankruptcy, on the other hand, allows for a reorganization of debts, providing a structured plan for repayment. This chapter may offer more options for homeowners looking to protect their assets.

Bankruptcy’s Immediate Impact on Mortgages

When bankruptcy is filed, an automatic stay is initiated, halting any foreclosure proceedings. This temporary relief gives homeowners a chance to reassess their financial situation and explore alternatives.

Long-Term Effects on Credit Score

Credit Score Implications

Bankruptcy can have a severe impact on credit scores, making it challenging to secure loans in the future. Understanding the rebuilding process is crucial for those seeking financial recovery.

Rebuilding Credit Post-Bankruptcy

Despite the initial blow to credit scores, there are strategic ways to rebuild. Responsible financial practices, such as timely bill payments and judicious use of credit, can gradually improve creditworthiness.

Potential Loss of Homeownership

Surrendering Property in Bankruptcy

In some cases, homeowners may have to surrender their property as part of the bankruptcy process. Understanding the implications of this decision is vital.

Mortgage Reaffirmation

Alternatively, homeowners may choose to reaffirm their mortgage, essentially agreeing to continue payments and retain ownership of their property. This decision requires careful consideration of financial feasibility.

Options for Homeowners in Bankruptcy

Loan Modification

For those facing financial difficulties, loan modification can be a viable option. Lenders may adjust the terms of the mortgage to make it more manageable for homeowners in distress.

Short Sale

In some cases, a short sale may be pursued, allowing homeowners to sell their property for less than the outstanding mortgage balance. While not an ideal solution, it can prevent foreclosure.

Government Programs for Homeowners in Bankruptcy

FHA Programs

The Federal Housing Administration (FHA) offers programs to assist homeowners in challenging financial situations. Exploring these options can provide relief for those navigating bankruptcy.

HARP

The Home Affordable Refinance Program (HARP) is designed to help homeowners with little or no equity refinance their mortgages. Understanding eligibility criteria is essential for those seeking this avenue.

Read More: Bankruptcy Alternatives for Financial Stability

Legal Consultation for Bankrupt Homeowners

Importance of Legal Advice

Navigating the complex landscape of bankruptcy and its impact on homeownership requires legal expertise. Seeking the guidance of an experienced attorney is crucial to making informed decisions.

Finding the Right Attorney

Choosing the proper legal representation is paramount. Researching and selecting an attorney with expertise in bankruptcy and real estate law ensures comprehensive support during the process.

Rebuilding Financial Stability

Budgeting Post-Bankruptcy

Creating a realistic budget is fundamental to rebuilding financial stability. Learning to manage finances effectively can prevent a recurrence of financial crises.

Establishing an Emergency Fund

Building an emergency fund provides a financial safety net. Having savings can mitigate the impact of unexpected expenses and contribute to long-term stability.

Community Support for Bankrupt Homeowners

Non-Profit Organizations

Numerous non-profit organizations offer support to individuals facing bankruptcy. These organizations provide resources, counseling, and assistance in navigating financial challenges.

Counseling Services

Professional counseling services can help individuals cope with the emotional and psychological toll of bankruptcy. Seeking support is a proactive step toward recovery.

The Emotional Toll of Bankruptcy

Stigma and Mental Health

The stigma associated with bankruptcy can take a toll on mental health. Acknowledging and addressing the emotional aspects of financial hardship is crucial for overall well-being.

Coping Strategies

Implementing coping strategies, such as seeking support from friends and family, can help individuals navigate the emotional challenges associated with bankruptcy.

Real Stories of Recovery

Success Stories

Highlighting success stories of individuals who have successfully rebounded from bankruptcy provides inspiration and practical insights for those currently facing financial struggles.

Lessons Learned

Examining the lessons learned from those who have overcome bankruptcy sheds light on effective strategies for recovery and financial resilience.

Future Planning for Homeownership

Credit Monitoring

Regularly monitoring credit reports allows individuals to track their progress in rebuilding credit. It also helps in identifying and addressing any discrepancies.

Financial Education

Investing in financial education equips individuals with the knowledge and skills to make informed financial decisions, reducing the likelihood of future financial crises.

Read More: The Legal Landscape of Bankruptcy: A Comprehensive Overview

Conclusion

In conclusion, the impact of bankruptcy on mortgages and homeownership is multifaceted. While it poses challenges, there are avenues for recovery and rebuilding. Understanding the options available, seeking legal advice, and proactively managing finances can pave the way for a brighter financial future.

FAQs(How Bankruptcy Affects Mortgages and Homeownership)

Can I keep my home if I file for bankruptcy?

The outcome depends on various factors, including the type of bankruptcy and the decisions made during the process.

How long does bankruptcy stay on my credit report?

Bankruptcy can stay on your credit report for seven to ten years, depending on the type filed.

Are there government programs to help homeowners in bankruptcy?

Yes, programs like FHA and HARP assist homeowners facing financial challenges.

Is it possible to buy a home after bankruptcy?

While challenging, it is possible to buy a home after bankruptcy. Rebuilding credit and financial stability is critical.

What should I look for in a bankruptcy attorney?

Look for an attorney with expertise in bankruptcy and real estate law, and consider their track record in similar cases.